Mega jackpots absent; instant ticket sales slow – not just us?

Hoosier Lottery revenues face “challenges” from a lack of mega-draw game jackpots and a “softening” in the lottery’s traditional bread-and-butter product, scratch-off tickets, lottery staffers acknowledge at the second 2025 quarterly meeting of the State Lottery Commission of Indiana . . . although we don’t know everything about the specifics because, as Lottery chief Sarah Taylor reminded commissioners, they were “able to be briefed on this in smaller groups” this spring, a tactic long employed by the lottery to circumvent the open door law.

The lottery confirms what we told you three months ago: Sales for Fiscal Year 2025 are expected to lag FY 2024, resulting in what will be a smaller amount of cash turned over to the General Fund this year than what may be any year since the pandemic.

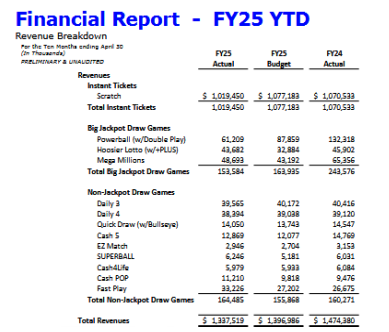

Through the first 10 months of FY 2025, revenues trail the budget by $59.4 million (- 4.3%), and are tracking $136.8 million (- 9.3%) below prior-year numbers. While surplus revenue to the State is running $3.4 million (1.2%) greater than Budget, it is also $33.1 million (- 10.4%) short of where it was on April 30, 2024. Officials forecast net income of just under $340.5 million, down by about $33 million (- 8.7%) from largesse to the state at the end of FY 2024.

Donald Redic, IGT Indiana’s overseer of the lottery under the management services contract, tells commissioners that “economic conditions can sometimes affect what our players can spend,” and “those economic conditions, we do believe, have contributed to some of the softness that we have seen in our scratch-off portfolio.”

Redic’s explanation is intriguing, because until the global banking fiscal crisis in 2008 – 2009, gaming revenues had proven inflation-proof in Indiana, growing through recessions, from lottery growth in the early 1990s through recessions failing to damper casino and lottery numbers in the early 2002s. Gaming officials even expressed their surprise to lawmakers in the initial decade or so of casino gaming about the counter-cyclical nature of Hoosier gaming revenue . . . and even the Hoosier Lottery saw growth in instant ticket purchases when gas prices soared; Hoosiers always seemed to have an extra dollar or two in their pockets after filling up at the pumps that they were willing to chance on lottery tickets.

Hoosier Lottery Chief of Staff Carrie Stroud, who is more familiar with lottery numbers across the decades than any other staffer, tells commissioners of the scratch-off fall-off that, “anecdotally …. It’s pretty consistent with what we’re hearing from other states.”

Mega-jackpots cannot be predicted or manipulated in the draw games outside of major adjustments to the rubric as we saw this spring with Mega Millions. Jackpot sizes – which drive sales – are “part of the business that we can’t control,” IGT Indiana’s Redic acknowledges. FY 2024 was very good to the lottery as a result of an unprecedented string of record and near-record runs (along with a major jackpot run for the homegrown Hoosier Lotto game), even as the current fiscal year has been unable to duplicate the same level of success.

Powerball Revenue is down by $26.5 million (- 30.3%) from Budget and crashes by $71.1 million (- 53.7%) from FY 2024 sales. While Mega Millions revenue is up by $5.5 million (12.7%)

over than Budget, its remains $16.6 million (- 25.5%) less than actual prior-year revenues.

By contrast, thanks to what was a continuing near-record Hoosier Lotto run (with each draw’s jackpot increments largely limited to $200,000 infusions), Hoosier Lotto revenue beats the Budget by $10.8 million (32.8%), but still falls $2.2 million (- 4.8%) shy of actual revenue in the prior-year period. A $42.5 million Hoosier Lotto jackpot was won in Perry County in March after a 15-month run that crossed fiscal and calendar years.

The non-jackpot draw game portfolio is enjoying a relatively successful 10-month period. Sales grow by $4.2 million (2.6%) over July – April in FY 2024.

However, scratch-off tickets are much more within the power of the provider to control via marketing campaigns and attractive games and price points . . . and players have failed to respond well to the FY 2025 product mix.

Scratch-off sales have plummeted by a hefty $ 57.7 million (- 5.4%) from Budget expectations, and have similarly plunged by $51.0 million (- 4.8%) from prior-year sales, despite claims of an attractive product portfolio, additional big-box store sales locations, and more convenient self-service purchase options.

Indeed, scratch-off sales are now on target for a fourth consecutive year of decline after last having grown during pandemic times, despite limited travel and commuting that should have depressed sales at traditional outlets (and recall from our monthly retailer rubric review that the top pre-pandemic retailers were largely the same as those who were big sellers during and since the easing of pandemic restrictions).

Even with the reduction in anticipated revenue for state coffers, IGT Indiana is on pace to reap an incentive payment projected at $5 million . . . although that figure is down by 36.2% from Budget and by almost $20 million (- 74.8%) from its FY 2024 draw game-driven bonus of almost $19.86 million.

“The largest jackpot we had was $527 million that was hit in March and with the runway we have between now and the end of the year, we will not make up that deficit,” Stroud explains to the commission.