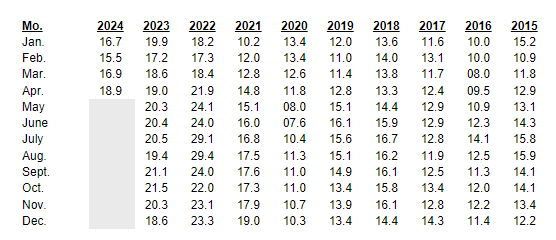

Time for every Hoosier’s favorite conversation topic: gas tax. After Indiana’s gas tax dipped from January to February, March 2024 saw an over-the-month increase, but added together, the first quarter of the year served up the lowest cumulative amount of gas taxes Hoosier consumers have seen in any three-month period since 2021. None of the three months in 2024 posted gains over the same month in 2022 or 2023 – although each was higher than the comparable months for any years from 2015 to 2022. The second quarter did not get off to such a suspicious start, as April resulted in the highest tax of the year to date.

Using the retail price of gasoline in Indiana for the period from February 16 to March 15, 2024, the Department of Revenue determined the statewide average retail price per gallon of gasoline to be $2.7031 for the period for the period, up from $2.4153 in March, $2.2104 in February, and from $2.3911 to open the year. Multiplied by the 7.0% state sales tax, the tax comes to 0.189217¢, or 18.9¢ after rounding to the nearest one-tenth of one cent. This increase comes just two months after February had served up the lowest tax rate since May 2021. The new calculation for April causes the gasoline use tax to increase by 2.0¢ from 16.9¢ (11.83%) per gallon from March to April, wiping out the $1.2¢ dip from January to February, and is 2.2¢ more than the tax we paid back in January.

The bad news: April becomes the second consecutive month of growth over the prior month, and likely just the beginning of a long stretch of such increases as Indiana is projected to see $4 per gallon gas perhaps yet this spring. The good news: the hike comes as Indiana welcomed an influx of out-of-state visitors for the April 8 eclipse, for which Indiana was in the Path of Totality (not to be confused with the condition which legislative Democrats have found themselves in for more than a decade now). We had a whole lot of out-of-staters filling up their tanks (maybe even their RVs!) with gas in Indiana at our April tax rate.

Of course, the gas tax is not the only number to bear in mind at the pump. You also need to calculate that on top of the state gas sales tax that rose to 34¢ per gallon on July 1 thanks to legislation raising the state gasoline tax signed in May 2023 by the Governor. There is also an additional 18.4¢ per gallon federal gasoline tax. That means drivers of vehicles with combustion engines in Indiana will be paying 71.3¢ in taxes, including 52.3¢ in state taxes, for every gallon of gasoline purchased in April . . . after February had been the first time in a few years that the state share slipped south of the 50¢ level. The cumulative April tax will be up from 69.1¢ in January.

Beginning in April 2023, the state gas use tax in each month of 2023 declined relative to the corresponding month in 2022, so we’re experiencing our 13th consecutive month of over-the-year decreases – more than one full year . . . even as we remain well below what would have been the trigger for that illusory 29.5¢ legislative cap from 2022, something we suggested at the time – with a justifiably high level of confidence – would likely never come into play. And this is probably the last time we mention that legislative nothing-burger.

February 2023 ended a sustained period of 23 consecutive months – more than 1¾ years – above prior-year levels for a streak which tops the September 2016 – December 2018 run, and after the record March 2023 tax had started a new run, we fell below prior-year tax numbers in April of last year. The positive takeaway was that May 2023 through January 2024 saw a substantially lower tax rate than one year earlier. We’re more 1½ years away from the record 73.2% over-the-year growth in the tax that Hoosiers endured from July 2021 to July 2022, and, indeed, the August 2022 to August 2023 plunge of 10¢ (- 34.01%) was the largest real and over-the-year percentage decline. The still-high April rate – though lower than that in any month of 2023, 2022, or the second half of 2021– comes 46 months (more than 3½ years) – after the June 2020 rate of 7.6¢ was the lowest monthly rate since we’ve been keeping records back in 2014. We’ve seen growth by a triple-digit percentage since then but moving back into the double-digits seems to be within sight.

After Hoosiers had paid monthly gas taxes tallying at least 17¢ per gallon (which, as we cautioned you in INDIANA LEGISLATIVE INSIGHT during the summer of 2021, appeared destined to stand as the new normal) for 30 consecutive months – more than 2⅓ years – for the first time in history, the amount seemed to have slipped below that threshold on more than just a temporary basis based on what we experienced during the first quarter of 2024 . . . but April shattered that thought. The variable gas tax has, however, now hovered north of 10¢ for 45 months – more than 3⅓ years. February also broke a streak of 32 months during which the rate had been 16¢ or greater. The 18¢ level, which was breached in December for the 24th time in recent history (and in 24 of the past 25 months), appeared to be largely in the rear-view mirror until April.

Although these fluctuations may not seem like much, according to Build Indiana Council (BIC) executive director Brian Gould, for every single cent the state raises the gas tax, $30 million is generated in yearly state revenue. This begs the question: if Indiana does continue shifting towards EVs, how do we make up this revenue? What about out-of-state EV drivers? If the only taxation lies in the registration fee, how do we capture the same amount of funds from EV/hybrid drivers as we do from gasoline-using tourists? Some believe the solution is to increase toll road fees and toll additional roads.

While the general populace is unlikely to cheer on increasing tolls, making supporting an increase a political nightmare, other industries have their concerns, too. Long-hauling freight with diesel-fueled trucks will become more expensive with this solution, placing an undue burden on truckers crossing state borders.

Indiana Motor Truck Association President and CEO Gary Langston emphasizes to us that, when it comes to EVs, trucks won’t see the benefits anytime soon, either. “[The trucking industry] will be using diesel for a long time…long-distance hauling doesn’t work with the current charge length for electrified trucks,” he forecasts. As the industry seeks to combat a severe shortage of drivers, increasing freight hauling times to integrate charging breaks would only exacerbate the problem.

Rep. Pressel asserts “[EV taxing] needs to be a part of the road funding conversation,” but also stresses that “everyone wants to talk about how much road funding we’re losing because of all the EVs and hybrids . . . that’s true, but it is a small number. [People] want to blame EVs.”

Considering Indiana’s less-than-ideal EV market forecast, Rep. Pressel’s comments should be relevant in the upcoming interim meetings – all of which we’ll cover in these pages.