Alfonso Straffon details what Indiana earned; where we rank

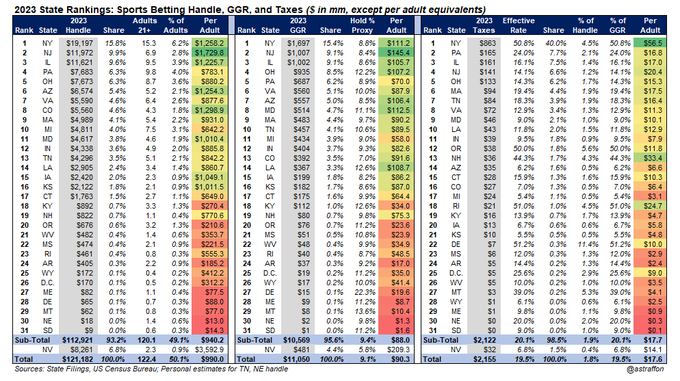

With 2023 numbers all now officially in, industry analyst Alfonso Straffon compiles a detailed listing of state-level sports wagering handle, gross gaming revenue, and taxes, each broken down into subcategories. Straffon performs this valuable public service for his @astraffon X (formerly Twitter) account, and we’ve extracted the Indiana-specific rankings for you.

Including Nevada, Indiana ranks 13th nationally in handle and third among our neighbors, trailing Illinois (fourth) and Ohio (sixth), in its debut year). Kentucky places 19th.

Our handle accounts for about 3.6% of the overall national handle, with our annual wagering of $885.8 per adult 21+ serving as 10th highest per capita, trailing Illinois ($1,225.7), but leading Ohio ($880.2) and Kentucky ($270.4 in its initial few months of experience).

When it comes to sports wagering, the Hoosier State also places 13th nationally in gross gaming revenue at $404 million, trailing the $1 billion+ Illinois performance fourth-best in the nation), and the almost $1 billion ($935 million) in Ohio GGR for 2023 (landing it in fifth place), but leading the $112 million in Kentucky during its attenuated first year. That GGR works out to $82.6 million per Indiana adults 21+ (14th nationally), below the $107.2 million in Ohio, $105.7 million in Illinois, but more than double the $34.0 million in Kentucky.

Indiana’s presumptive hold rate calculates out to 9.3%, with 19 states (and the District of Columbia) posting more house-favorable hold than Indiana and 11 states more patron-friendly than us.

Indiana reaps about $39 million in taxes from sports wagering during 2023 at our tax rate of 9.5% (higher than the effective tax rate in only eight other states), finding us 11th nationally in this bottom-line ladder, trailing Illinois ($161 million from an effective tax rate of 16.1%), Ohio ($133 million from an effective rate of 14.3%), and ahead of Kentucky in its brief experience ($16 million and a 13.9% effective tax rate).

Indiana accounts for only 1.8% of all sports wagering taxes collected, just 0.9% of handle, a lower percentage than only six other states last year.

Indiana’s taxes as a share of gross gaming revenue from sports wagering is 9.5%, a lower percentage than only eight other states. Sports wagering taxes translate into $7.9 per adult, with only 14 states serving up a lower such percentage based up Straffon’s data.